Frequently Asked Question Investing in Unit Turst

What is Unit Trust ? Unit trust is a collective investment from investors (unit holders) pooling their cash which allowed the funds manager(unit trust management company) to invest in a portfolio of securities or other assets.

Why Invest in Unit Trust?

1. Investment Exposure to various type of asset classes i.e.

Diversification.

2. Professional Management by experienced Fund Managers.

3. Lower Investment Cost, everybody can invest in unit trust.

Is Unit Trust a safe Investment?

Any investment involves risk but unit trust risk is reduced through

diversification.

How to make your unit trust investment more profitabe?

The best practice is through regular investment because ...

1. No market timing worries. Market timing is confusing and causes

anxiety, a question whether or not you are doing the right thing.

2. Applying Dollar Cost Averaging Principle. Investing on regular

intervals at a fixed amount will average the cost of investments. In other words

you buy more when the price is low and less when the price is high.

3. Flexibility and Affordable. You can start as low as RM100 monthly and increase the amout as your disposable income grows.

What is Cooling-off Rights?

1. Safeguard for investor who may have purchase units without fully

understanding unit trust investing concept.

2 Exercise within 6 business day with FULL Refund in: - NAV/unit for

the purchase day - Service charge/unit imposed for the purchased day

3. Only applicable for First Time investing with the respective Unit

Trust Management Company.

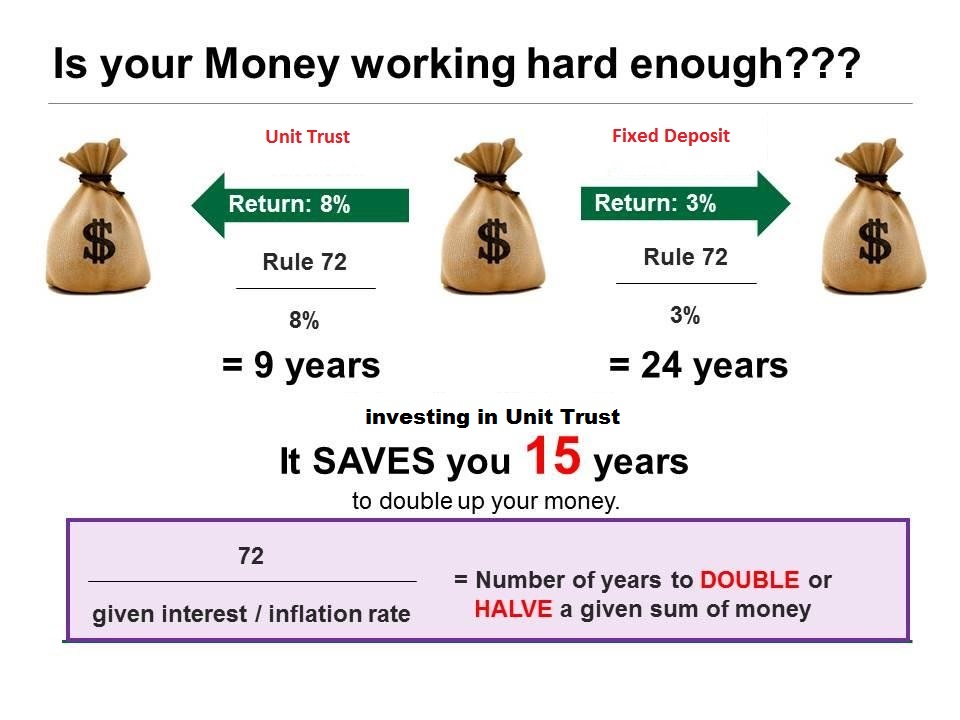

ARE YOU READY TO DOUBLE YOUR MONEY INVESTING IN UNIT TRUST?

|

|

|

|